The allure of classic car ownership is undeniable, but for a select few, it transcends mere passion. It becomes a high-stakes, high-profit enterprise. If you’ve moved beyond the rudimentary advice of ‘buy low, sell high’ and are ready to operate at a professional level, you’re in the right place. This is not another hobbyist’s guide; it’s a strategic business framework designed to elevate your classic car ventures into a consistently profitable business. Forget simple tips; we’re providing a comprehensive playbook for sourcing undervalued assets, managing complex restorations for predictable ROI, and mastering the market’s intricacies. Drawing on over 35 years of hands-on industry experience in transforming classic cars into investment-grade assets, this is the definitive guide for the serious investor.

Strategic sourcing and valuation: finding undervalued assets in a buyer’s market

In a market that many perceive as “cooling,” the real opportunity emerges. It’s a market that rewards strategy over speculation. The key isn’t just finding a car; it’s about identifying the right asset at the right price, an asset whose value trajectory is poised for growth.

Developing your investment thesis: what to buy and why

Success begins with a clear investment thesis. Don’t chase cars; chase opportunities backed by data.

- Define your niche: You can’t be an expert in everything. Become a specialist. This could be by marque (e.g., air-cooled Porsche), by era (e.g., pre-war tourers, 60s muscle, ‘youngtimers’), or by condition (e.g., preservation-class originals, rolling restorations). A defined niche sharpens your focus and builds your reputation.

- Analyze market trends vs. chasing fads: Use data to identify models with a rising value curve. Key indicators include production rarity, motorsport pedigree, cultural significance, and demographic shifts in ownership. While others chase headline-grabbing auction results, the astute investor looks for the next segment poised for growth. For in-depth classic car market research, official industry reports are invaluable.

- The rise of ‘youngtimer’ classics: Cars from the 1980s, 90s, and early 2000s represent one of the most significant opportunities today. Models like the Porsche 944, BMW E30, and Mercedes-Benz 190E have a devoted following, excellent parts availability, and a more accessible entry point than their older counterparts. Their buyer profile is different—often younger, valuing analogue driving experiences with a touch of modern usability.

Advanced sourcing channels beyond the dealership

The best deals are rarely found on a pristine showroom floor. Overpaying at auctions and dealerships is a common pitfall. To find true value, you must look where others don’t.

- Mastering online platforms: Go beyond casual browsing on Bring a Trailer, Hemmings, or Car & Classic. Use advanced search operators to find poorly presented listings. Look for listings with bad photos, minimal descriptions, or owners who clearly don’t know what they have. These are often where hidden gems lie.

- Building a private network: The most valuable assets often trade hands privately. Cultivate genuine relationships with marque-specific owners’ clubs, specialist mechanics, and even estate lawyers. These connections provide access to a flow of off-market vehicles before they’re ever publicly listed.

- The art of the private purchase: When you find a potential car, approaching the owner directly requires tact and knowledge. Conduct your initial inspection with a professional but respectful demeanor. When it’s time to negotiate, do so from a position of deep knowledge about the specific model, its common issues, and recent comparable sales.

Rigorous due diligence and valuation

Emotion is the enemy of profit. Every potential acquisition must be subjected to a ruthless and systematic evaluation.

- Using professional tools: The Hagerty Valuation Tool is more than a price checker. Use it to track a specific model’s value trends over 1, 3, and 5 years. Is the value flat, climbing, or declining? This data is critical for forecasting your potential return.

- Pre-purchase inspection (PPI) checklist: Your inspection must go far beyond a standard mechanical check. Key areas for a professional flipper include checking body panel gaps for consistency, looking for date-stamped components (glass, seatbelts) to verify originality, and using a paint depth gauge and magnet to find signs of hidden rust or body filler.

- Verifying numbers and provenance: This is non-negotiable. Cross-reference the chassis (VIN), engine, and body numbers with factory records, heritage certificates, and historical registries. A car with “matching numbers” is fundamentally more valuable than one without.

The restoration balance sheet: maximizing ROI without sacrificing soul

A successful flip is budgeted before the first wrench is ever turned. The restoration phase is where profits are either solidified or destroyed. It requires a delicate balance of financial discipline, strategic decision-making, and a deep understanding of the target buyer.

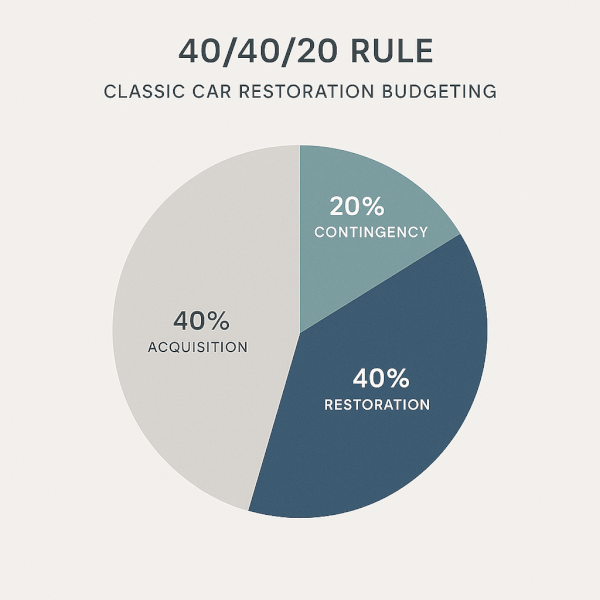

Forecasting total project cost: the 40/40/20 rule

To avoid the catastrophic budget overruns that plague amateur restorers, adopt a professional framework. We use the 40/40/20 rule as a baseline for financial planning.

-

Framework:

- 40% for vehicle acquisition: This is the maximum you should pay for the base car.

- 40% for restoration: This covers all anticipated parts and labor.

- 20% for contingency: This is your safety net, reserved for unforeseen issues, specialist fees, and other hidden costs.

- Hidden expenses: A professional budget accounts for everything. This includes vehicle transport, specialist tool rental or purchase, international parts sourcing fees, secure storage, and the eventual costs of marketing and selling the car.

- Line-item budget: Create a detailed, line-item budget before you purchase the car. This exercise forces you to research costs for parts and labor, creating a realistic forecast of the project’s ultimate profitability.

Sample Restoration Budget: 1990 BMW E30 M3 Project

| Category | Item | Estimated Cost | Notes |

|---|---|---|---|

| Mechanical | Engine Rebuild (parts & specialist labor) | £8,000 | Includes new bearings, seals, timing chain |

| Gearbox & Differential Service | £1,500 | Seals, fluid, inspection | |

| Suspension Overhaul (shocks, bushings) | £2,000 | OEM or high-quality equivalent | |

| Body & Paint | Media Blasting to Bare Metal | £1,800 | Essential for finding all rust |

| Rust Repair (sills, arches) | £4,000 | Labor-intensive, crucial for value | |

| Full Respray (period-correct color) | £10,000 | High-quality, multi-stage paint job | |

| Interior | Upholstery Repair (front seats) | £1,200 | Using correct materials |

| Dashboard Refinishing (crack repair) | £500 | Common E30 issue | |

| Consumables | Brakes, Tires, Fluids | £1,500 | Non-negotiable safety items |

| Subtotal | £30,500 | ||

| Contingency (20%) | £6,100 | For unforeseen issues | |

| Total Est. Cost | £36,600 |

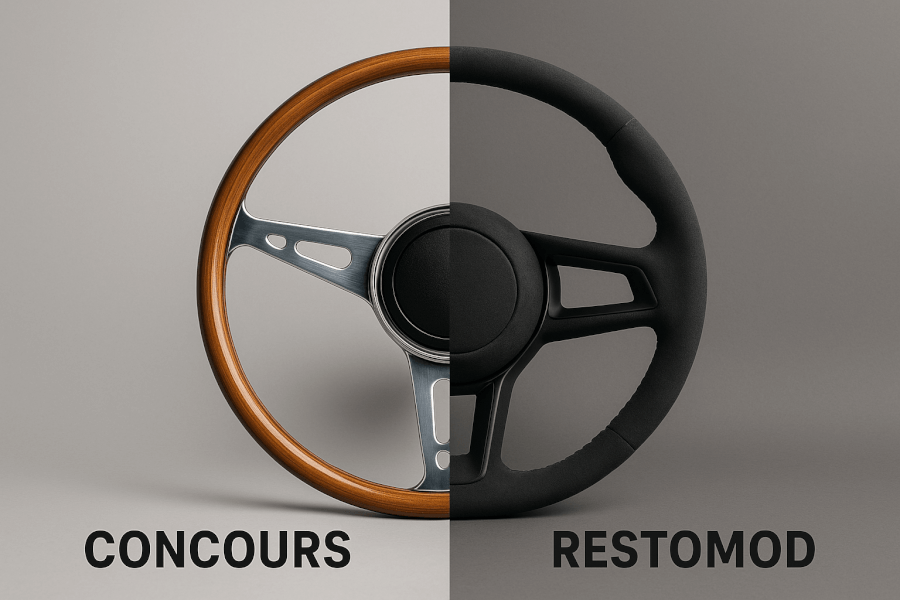

The critical decision: authenticity vs. strategic upgrades

The single most important restoration decision is defining the end goal. Who is this car for? The answer dictates your approach.

- ‘Concours’ vs. ‘Restomod’: You must choose a path. A ‘Concours’ restoration aims for perfect, factory-correct originality at all costs and appeals to purist collectors. A ‘Restomod’ (restoration + modification) strategically enhances performance, safety, and usability to appeal to a driver who wants a classic experience with modern reliability.

- Value-add upgrades: Not all upgrades are created equal. For a restomod, improvements like electronic ignition, upgraded brake pads and lines, a modern (but hidden) sound system, or a highly efficient air conditioning system can significantly increase value and appeal. Conversely, oversized modern wheels or a non-period-correct engine swap can destroy it.

- The parts sourcing challenge: This is a core competency. You must know where to find New Old Stock (NOS), original equipment manufacturer (OEM), and high-quality reproduction parts. The key is understanding when ‘correct’ is more important than ‘new’. For a concours car, a refurbished original component is often more valuable than a brand-new reproduction part.

From the workshop: Sas case study

Theory is one thing; execution is everything. This real-world example demonstrates how these principles deliver results.

- Project Overview: We acquired a 1966 Jaguar E-Type Series 1 4.2L Roadster. It was a numbers-matching car with good provenance but suffered from a poor, older restoration with significant hidden body corrosion.

- The Challenge: After stripping the car, we discovered extensive, poorly repaired rust in the floor pans and inner sills, far beyond what was visible during the initial inspection. The car’s structural integrity was compromised.

- The Strategic Decision: The target market for a Series 1 E-Type values authenticity above all else. Instead of simply patching the floors, we made the decision to acquire complete new floor pan and sill assemblies from a heritage-approved supplier. This was a more expensive and time-consuming route, but it was the only way to guarantee structural correctness and satisfy a top-tier buyer. We chose to retain and professionally rebuild the original engine and gearbox rather than opting for a modern alternative, preserving the car’s critical ‘matching numbers’ status.

- The Result: The restoration was meticulously photo-documented. By making the strategically correct (though more difficult) decision, we created an asset with unquestionable structural and mechanical integrity. The vehicle was sold at a premier auction, achieving a final sale price that represented a 35% ROI over the total project cost, far exceeding the return had we taken shortcuts.

Mastering the market: provenance, positioning, and timing the sale

The restoration is complete, but the work isn’t done. How you document, present, and sell your asset is just as critical as the quality of the restoration itself.

Building a bulletproof history file

A car without its story is just metal. Provenance is one of the most powerful, yet often overlooked, value-multipliers.

- The power of provenance: A thick, well-organized history file provides tangible proof of a car’s past and the quality of your work. It builds trust and allows a potential buyer to connect with the vehicle on a deeper level.

- Essential documentation: Your file must be comprehensive. At a minimum, it should include any original bill of sale, a complete chain of service invoices, a detailed ownership history, a heritage certificate from the manufacturer, and all receipts from your restoration.

- Meticulous restoration documentation: Photo-document every single stage of the restoration. Start with ‘before’ photos from every angle. Document the teardown, the bodywork in progress (especially rust repair), the engine rebuild, and the final assembly. This visual record is irrefutable proof of the quality of work that lies beneath the shiny paint.

Marketing your asset for maximum return

You’ve built a world-class product; now it needs world-class marketing.

- Choosing the right sales channel: The channel must match the asset. A multi-million-pound Ferrari belongs at a high-end auction house like RM Sotheby’s. A sought-after ‘youngtimer’ will thrive on an online auction platform like Bring a Trailer, which has a dedicated community for such cars. A unique, story-rich vehicle may be best sold privately to a known collector.

- Crafting the perfect listing: This is your sales pitch. Invest in professional photography that captures the car’s best angles and details. Write a compelling, story-driven description that highlights its history, the restoration philosophy, and its key features. Be completely transparent about the vehicle’s condition, both good and bad.

- Preparing for buyer questions: Serious buyers will ask tough, technical questions. Have all your documentation digitized and ready to share instantly. Be prepared to speak with authority on every aspect of the car, from the type of brake fluid used to the specific paint code.

Bulletproofing your business: legal essentials and risk mitigation

Transitioning from a hobby to a business means adopting professional standards of legal and ethical conduct. Ignoring these responsibilities is the fastest way to ruin your reputation and your profitability.

Navigating dealer license and tax requirements

The moment you start flipping cars for profit, you are operating a business.

- Understanding the threshold: In the UK, there is no hard-and-fast number, but if you are buying and selling several cars per year with the primary intention of making a profit, you are likely considered a motor trader by HMRC. This requires a dealer’s license.

- VAT and income tax implications: Once you are operating as a business, you must register correctly. You will need to handle VAT on sales (using the Margin Scheme for second-hand vehicles can be beneficial) and pay income tax on your net profits. Professional accounting advice is essential here.

- Legal business structures: Operating as a sole trader is simple, but it leaves you personally liable for any debts. Forming a limited company (Ltd) provides liability protection, separating your personal assets from the business.

Mastering titles, disclosure, and the bill of sale

Trust is your most valuable currency. How you handle paperwork and disclosures defines your business.

- The danger of title jumping: This is the act of buying a car and selling it on without ever registering it in your name (or your company’s name) on the V5C log book. It is illegal, evades tax, and is a massive red flag for any knowledgeable buyer. Always register the vehicle in your name. Period.

- The principle of full disclosure: Ethically and legally, you must disclose all known significant issues. This includes a salvage or accident history, major non-original components, or any known mechanical faults. Hiding problems leads to legal disputes and destroys your reputation.

- Crafting a detailed bill of sale: A comprehensive bill of sale protects both you and the buyer. It should include the date, price, vehicle details (VIN, mileage), and essential clauses like ‘sold as seen, where is,’ an accurate odometer declaration, and a list of all included documents (history file, spare keys, etc.). Consult the UK government rules for historic vehicles to ensure you are compliant.

Sourcing from abroad: UK import regulations

Expanding your sourcing to the EU or US can unlock incredible opportunities, but it requires navigating a specific set of rules.

- Key considerations: Before buying, research the target vehicle’s history abroad just as you would in the UK. Be aware of potential import duties and VAT, which can significantly impact your budget.

- The process: Importing a vehicle involves a customs declaration (through the NOVA system), paying any applicable duties, and potentially needing vehicle approval to ensure it meets UK standards before it can be registered with the DVLA.

- Title documents: Ensure the foreign title documents are clear and correct. The process is detailed but manageable if you follow the official guide to importing vehicles.

Key takeaways: your strategic checklist

- Develop a thesis: Don’t just buy what you like; buy what the market data suggests has growth potential.

- Budget rigorously: Use the 40/40/20 rule to ensure profitability from the outset and avoid costly surprises.

- Balance authenticity & upgrades: Make restoration decisions based on the target buyer and potential ROI, not just emotion.

- Document everything: A comprehensive history and restoration file is your most powerful value-add.

- Stay compliant: Handle titles, taxes, and disclosures professionally to build a sustainable, trustworthy business.

Frequently asked questions

Is it profitable to restore and sell classic cars?

Yes, it can be highly profitable, but it requires a strategic business approach, not just technical skill. Profitability depends entirely on rigorous budgeting, smart vehicle selection, and understanding the market, as outlined in this guide. Success is planned, not accidental.

What is the best car to flip for profit?

There is no single ‘best’ car; the most profitable flips are often found in undervalued market segments like ‘youngtimer’ classics (e.g., Porsche 944, BMW E30, Mercedes-Benz 190E 2.3-16). Success comes from applying a strong investment thesis rather than chasing the same models as everyone else.

What is the most difficult part of car restoration?

From a profitability standpoint, the most difficult part is often unseen bodywork and rust repair, as the true extent of the damage is unknown until the car is fully stripped down. From an authenticity standpoint, the most difficult part is sourcing rare, date-correct parts without overpaying or compromising on quality.

What are the legal requirements for selling restored classic cars in the UK?

The key legal requirements include ensuring you have the proper V5C log book in your name (or your company’s name), accurately and honestly representing the vehicle’s condition, providing a detailed bill of sale, and, if you sell multiple cars per year for profit, obtaining a motor trade license and registering with HMRC for tax purposes.

Conclusion: building your legacy in the classic car market

Success in the world of high-end classic car restoration and sales is achieved when immense passion is guided by an equally immense professional and strategic framework. It marks the transition from enthusiast to investor—a shift in mindset that prioritizes ROI, risk mitigation, and market intelligence as highly as craftsmanship. By implementing this playbook, you’re not just flipping cars; you’re building a portfolio of investment-grade assets and a reputation for excellence.

Ready to turn your next project into an investment-grade asset? Contact the SAS team to see how our 35 years of experience can bring your vision to life.